Thomas Piketty: It's the inequality, stupid

Before taking a big Budget stick to the poor and

underprivileged, Treasurer Joe Hockey should review the research of

economist Thomas Piketty, who shows that increasing inequality

undermines democracy and stifles growth. Professor Thomas Clarke comments (via The Conversation).

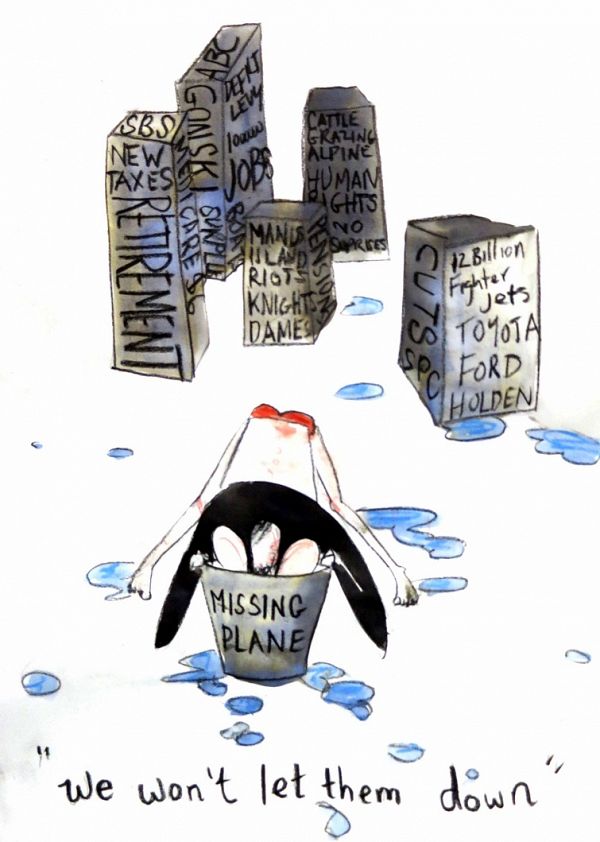

THE COALITION GOVERNMENT is currently rehearsing a well-honed

rhetoric on “everyone having to do the heavy lifting” to justify

Treasurer Joe Hockey’s slash and burn budget on social services and

pension entitlements.

But perhaps he might pause a while to consider a new book making

waves around the world, which provides two centuries of financial data

from 20 countries directly confounding Hockey’s central assumptions on

the sources of growth.

French economist Thomas Piketty’s new book, Capital in the 21st Century

has been generating an increasing amount of heated commentary with the

argument that increasing inequality is undermining democracy and

destroying the chances of equitable opportunity and sustainable growth.

Piketty argues – with the support of a massive amount of economic

data – that the problem is not caused by the benefits paid to the poor,

but the increasing wealth commanded by the rich (such as those happy to

pay $500 a plate at Liberal fundraisers).

Hockey is an old-fashioned believer that state intervention crowds

out entrepreneurial initiative, individual enterprise is checked by

state benefits, and that public debt is a continuous drag on economic

growth.

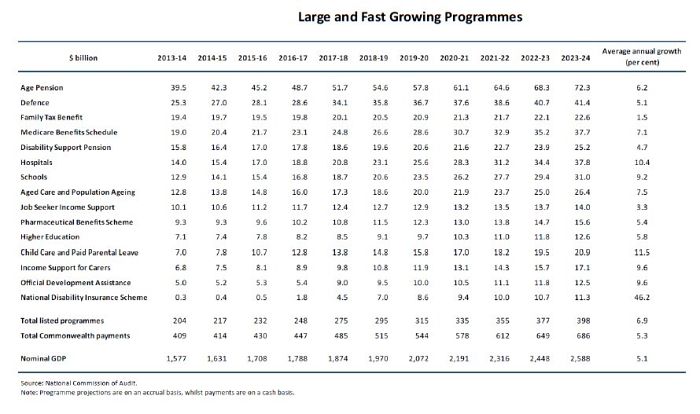

This week Hockey will publish the report of his hand-picked Commission of Audit to support his view that only dramatic cuts in benefits in the medium term can sustain growth.

Piketty demonstrates that Hockey is looking at the problem through

the wrong end of the telescope; the problem is the increasing

concentration of wealth of the rich, not a lack of incentives for the

enterprising.

It is amazing the Financial Times, the Wall Street Journal, The Economist, the Huffington Post and the New Yorker magazine – among many mainstream media – are all earnestly debating Piketty’s devastating critique of increasing inequality.

Any consideration of inequality has been out of fashion for decades.

Reagan and Thatcher cauterised any sensitivity to the causes of

inequality stone dead with their disinterment of a laissez-faire

celebration of free enterprise. Yet Picketty’s book on inequality is now number 1 on Amazon’s top 20 books list.

And Piketty is an economist!

With honourable exceptions such as A.B. Atkinson in the UK, and Paul Krugman, Joseph Stiglitz, Robert Reich and Emmanuel Saez

in the U.S., with regard to the question of inequality, economists have

been trapped in the fatal embrace of the efficient market hypothesis

and studiously pursued quantitative modelling of increasingly obscure

hypotheses.

Nobel prize winning economist Paul Krugman has said Piketty’s Capital inspires

“... a revolution in our understanding of long-term trends in inequality.”

From his more productive tunnelling through 200 years of meta-data,

Piketty has emerged with the following dramatic propositions:

There is no general tendency in market economies towards equality.

The reduction of inequality after the Second World War was caused by

enlightened policy including progressive taxation. The erosion of

progressive taxation in which the rich pay proportionately more than the

poor, has in effect recreated the conditions for the return of the

domination of inherited wealth of the 19th century. A new domination by

dynastic wealth.

The drift back to extreme inequality is apparent in all of the advanced industrial countries,

particularly the US and UK. Picketty demonstrates that while in the US

the richest 1% of households took 22.5% of total income in 2012, what is

even more worrying is the trend since: “the richest 1% appropriated 60%

of the increase in US national income between 1977 and 2007.”

Accelerating this trend towards increased inequality is the rapid inflation in the reward of top executives in the US and the return of the system of inherited wealth of patrimonial capitalism in Europe.

These tendencies are worsening as the accumulation of

capital continues to grow while Western economies have slowed in recent

decades. The return on capital has outpaced the growth in economic output.

Piketty’s policy recommendations hark back to a different era

– the democratic reformist zeal of the post-war period when higher

marginal tax rates for the rich, and inheritance taxes were seen as

essential to economic progress, not punitive.

The alternative we are now facing is the return of plutocracy, as Piketty comments: “Inequality

is fine as not long as it is not completely excessive. At the end of

the day, it’s hard to make democratic institutions work if you have 95%

of the wealth in the top 10% of people."

Assumptions that inequality is necessary for economic growth are largely groundless: a more unequal society fails to deliver economic growth.

Austerity measures simply focused on reducing

national debt, by reducing the capacity of other essential services such

as health, education and social support, can compound inequality and further restrain growth.

Where will this extreme inequality end?

A recent Oxfam report suggests the richest 85 people in the world – the likes of Bill Gates, Warren Buffett and Carlos Slim – own more wealth than the roughly 3.5 billion people who make up the poorest half of the world’s population.

Inequality is not an accident, it is a result of the way we run our

government and economy. Hockey claims this budget (and his budgets to

come in the medium term when the more serious cuts will be made) is

directly focused on removing the fetters on economic growth. In reality

it is focused on removing the fetters on increasing economic inequality.

This article was originally published on The Conversation. Read the original article.